What’s going on in SME Exchanges?

Often in the times of extreme panic & euphoria markets tends to paint everything with same brush and i have been looking for the business of primarily of two categories

- Stronger Businesses became even more stronger due to covid-19 because of market share shift from weaker players.

- Covid-19 opened up new lines of revenue for the company due post Covid-19 market requirements and there is no harm to pre-covid 19 business model after things get back to normal.

And most importantly markets are not pricing in these two factors into the market cap of the businesses.

The biggest casualty of Covid-19 has been on SME sector and there is no doubt the SME exchange 90+ listed companies (at least the companies i feel worth tracking here) have corrected 70-90 % except two chemical companies 1) Valiant Organics 2) ChemCrux and of these significantly “price corrected” companies, i don’t find many fitting the above two criteria.

However i feel there are two companies which will benefit (At Least will not see any significant impact) due to Covid-19 but have corrected meaningfully.

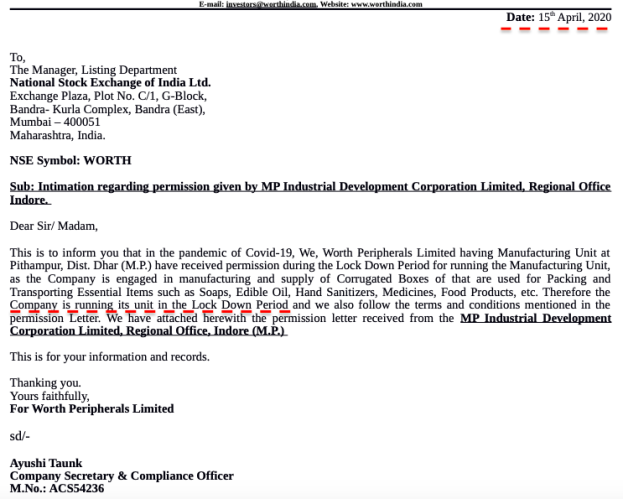

1) Worth Peripheral ltd –

This stock has corrected -75% from all time high, which was too high for a corrugated box company and corrected almost -40% from the listing day price which was too high as well.

As i have written about it in my blog, this is a good business to own at or below <5 PE (0.75 x BV) as there will be 6-7% growth over a long term and due to Demonetization, GST and COVID they will gain some market share from unorganized and highly leveraged competitors and bad times always rewards the wonderfully run businesses like Worth Peripherals Ltd.

And that’s why any direct cash transfer to badly run SME businesses by Gov dis incentivise businesses like worth peripherals ltd to run conservatively, as they always do even during the good times.

The reason why I like that Gov continued to rely heavily on liquidity support rather than direct cash transfers, Liquidity through various market instruments will find the good businesses who deserve the capital and bad ones will deservably die.

Although the price corrected meaning fully ( not as much i like though) from its intrinsic value the intrinsic value of the business has not corrected at all in my view.

As you see the company received permission during the Lockdown Period for running the Manufacturing Unit, because the Company is engaged in manufacturing and supply of Corrugated Boxes of that are used for Packing and Transporting Essential Items such as Soaps, Edible Oil, Hand Sanitizers, Medicines, Food Products, etc.

Due to the nature of its operation tightly linked to FMCG companies, it’s hard to justify the price correction by the market in today’s scenario, like it was very hard to justify its post IPO valuation of Rs 120 /- per share.

I’ll not talk about this company in detail in this post as i have already written in detail about it (you might find it interesting) –

https://dhruvapandey.wordpress.com/2017/11/12/worth-peripherals-ltd/

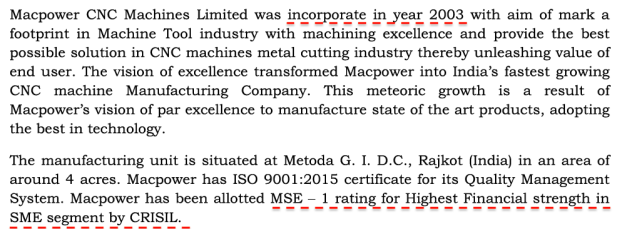

Another interesting business which i think didn’t see any meaningful correction in its intrinsic value but has seen significant market cap correction (it’s really significant – I like that kind of correction) is Mac Power CNC Ltd.

I have been following this company since IPO, There was a lot of euphoria around it during the IPO with market cap impossible to justify. One justification could be due to reason below –

Company risen over 50% since listing was a normal sighting during those days as investors had zero weightage to valuation and very high weightage to things like “who are the anchor investors”, LM, “migration to main board” etc. even though it’s not very hard to see these things do nothing to the present value of future cash flows of the business nor provide any margin of safety.

No surprise that the stock is down -90% from all time high and -80% from the day 1 listing price.

But what surprised me is business has not been affected by the Covid-19, In Fact they gained new business from the crisis which was not there at all in the Precovid-19 era.

Why did they come up for the IPO?

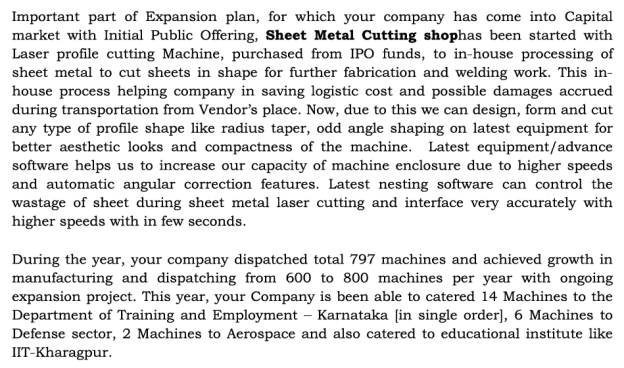

They raised Rs 35 Cr FUND through IPO primarily to do backward integration.

Which they were expecting to give a 4-5 % jump in margins.

Let’s try to understand more about the business –

2) Mac Power CNC ltd –

What is a CNC machine and how does it work ?

A CNC machine is a computer controlled carving machine. It generally speaks G Code that instructs the machine how to move, what feed rate and spindle speed to use, which cutting tool should be in the spindle, etc. The cutter that the machine has in the spindle will carve through the material (generally metal) and create the intended shape. The material that has been removed is called “chips” and it will usually be recycled.

In most cases a CNC machine is programmed by a programmer using CAM software who uses the software to apply tool paths to a 3D or 2D model of the part they want to make. Once the programmer has finished his/her programming work, the program is fed into a post processor which will turn the CAM program into the G code the machine can read. The G code is uploaded into a the CNC machine along with all the cutting tools needed, raw material and work holding needed to hold the raw material. Then a machinist will put the machine into automatic mode and start the program to make the part.

Src- link

If you like visual description follow the link blow –

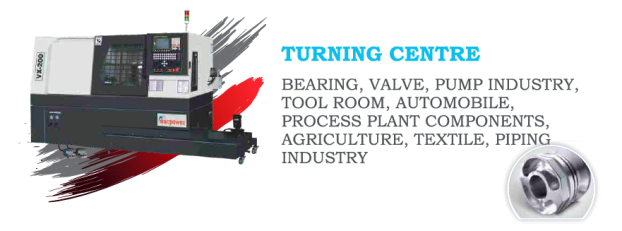

What types of machines do they make ?

They make basically three types of CNC machines –

- Vertical Machine Center.

- Horizontal Machine Center.

- Turning Center.

There are many variants of these machines which are part of Catalog shown below –

The full catalog can be downloaded from here –

Click to access general-brochure.pdf

What do these machines do ?

Well, you can use machines like Turning center to make millions of these fine threaded nuts and bolts shown below with 99.9 % accuracy.

Similarly, there are various types of machines to built different metal parts mentioned below –

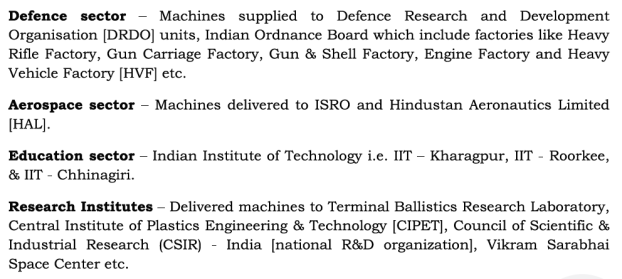

Not only that they also make high value specialized products as per demand of the customers, Mainly these orders come from the aircraft and defence sector which constitutes about 35-40% of the companies revenue (FY18)

How much do these machines cost ?

Depending on the Machine type, A machine from the catalog can cost Rs 10 lacs and can be made available in 2 days and a more complicated machine can cost Rs 2 to 5 Cr, could take 20 days to manufacture.

Who are their customers?

Automobile, General Engg, Pumps / Motor Engg,, Defense , Aircraft companies, Education sector, Automobile etc.

Key Sectors –

They had approx 425 employees FY18.

How is the competitive landscape in the CNC industry ?

There are only 7-8 players in India who make more than 500 machines per annum –

No. 1 Player is –

- ACE designers bangalore – They do around Rs 1200 Cr of revenue per annum.

Other significant players who all do about Rs 500 Cr of revenue are –

- Bharat Fritz Werner Limited – Acquired plant of European company.

- Lakshmi Machines works – Listed in main board trades very expensive compared to macpower.

- Jyoti CNC – Acquired plant of European company.

Whereas MAC power does about Rs 100 Cr of revenue and they make all the products these companies offer and at cost lower than the competition.

They are as big as these players in sales and distribution, Most importantly in this industry you get more orders due to the customer referral. So, it’s hard for new players to come into the market and build reputation.

Macpower or others don’t face any problem with getting orders, all companies are constrained by the execution “ number of machines they can build in a year”. India is a net importer of CNC machines about >55% of the requirement is imported.

Total market size of these machines in India is around – Rs 19000 Cr, India produces Rs 8-9000 Cr worth of machines and 55-60% imported.

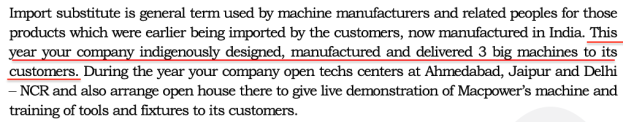

In case any CNC company make import substitutes they get a good market to capture because of various incentives from Government to procure made in India Machines, Tax benefit ( with GST you get tax benefit on buying from India) and Cost of making in India is way more competitive Vs imported machines.

One example is from the last 5 years indian companies have been making and selling Horizontal Machine Center which costs around Rs 2Cr used to be imported by industry earlier.

This from AR FY19 Mac power CNC –

There are basically two types of orders they get –

- Replacement Order.

- New machine requirement.

Replacement order –

When customers move from conventional machines to CNC machines.

By replacing conventional machines with CNC they can free up 5-8 laborers and CNC gives them more accurate finished products.

This is a recession free business as companies tend to cut labor cost, improve efficiency during recession and replace their old conventional machines with CNC. ( typical catalog machines costs around Rs 1 lac to 10 lac makes sense for customers from cost perspective)

New machine requirement –

These are high value adding products from the overall margins prospective for the company, As they develop these machines they get other service, training and maintenance related contracts too for the machine.

These orders generally come from the defense sector for the Mac Power CNC ltd.

How about working capital requirements?

That’s where I think business has some traits of being a good business.

For most businesses barring few like banks, nbfcs cash comes in when you make a sale and believe it or not banks & nbfcs the cash goes out when you make a sale and what is worse is this cash which went out on making a sale is always borrowed from someone else – ( terrible business) on an average industry destroys wealth. If you don’t believe me try borrowing some money and lend it to even someone you know.

Then there are very few businesses where you get cash in advance before you make a sale meaning you have negative working capital requirements.

Mac power CNC falls into this category –

In this industry mostly customers come to you with certain product (Machine) requirements and token of advance money to make it for them.

For the catalog products they get advance around 5-10 % (around Rs 1 lac per machine) and for special purpose machines they get around 25-50% in advance.

To make machines mostly they have to source 20-30% of the components from companies like Siemens or some company in Japan and for that they get 30-150 days of credit and mostly they finish making machines in 2 to 20 days of time which keeps them working capital negative by requirements.

As you can check from the balance sheet they don’t require any debt to run this business and of Rs 109 Cr of total assets they have about Rs 30 Cr (30%) parked in the liquid funds (it’s still part of the cash they raised through IPO ~ Rs 35 Cr.)

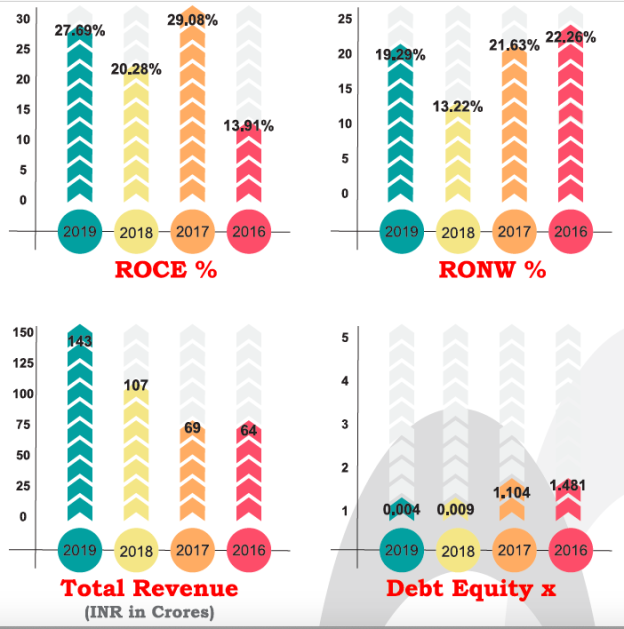

And earns decent return of capital –

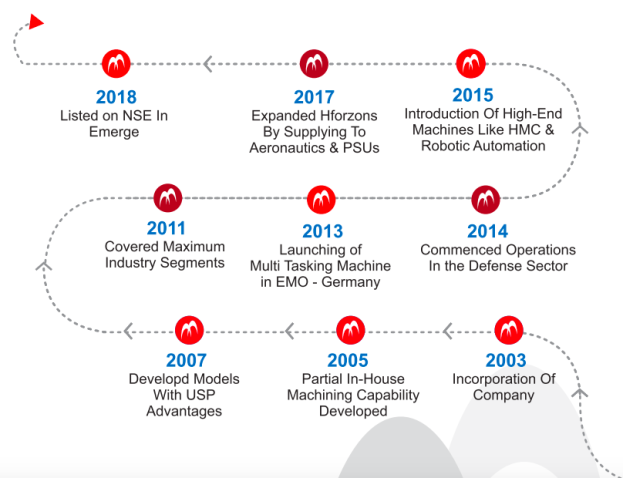

How they have evolved over time –

The company has been doing great before going into the Covid-19 crisis –

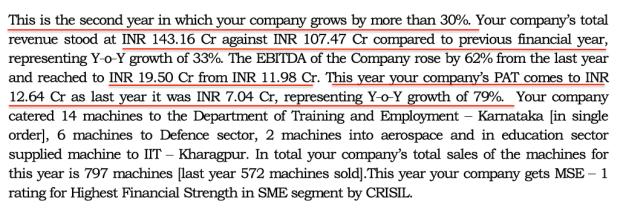

FY19 –

Their revenue grew by 30%, PAT grew by 79%.

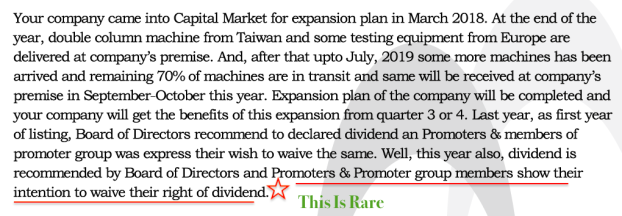

Their Expansion plan was right on track –

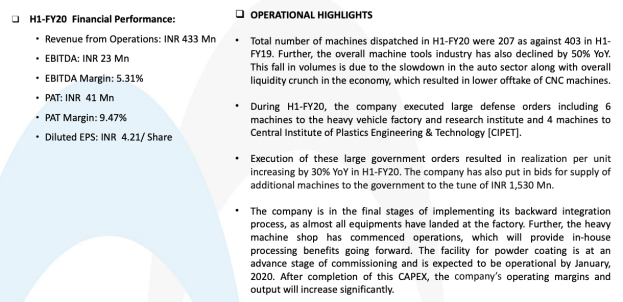

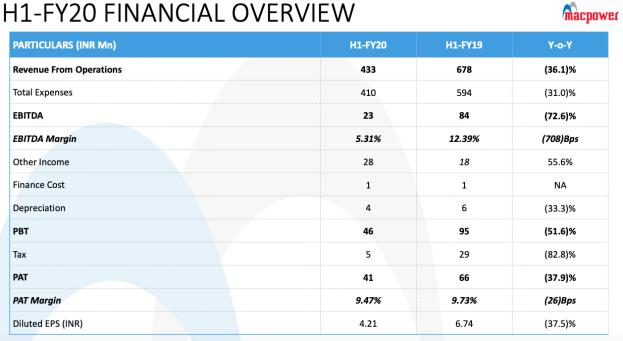

However we do see some weakness in the first half of the FY20 –

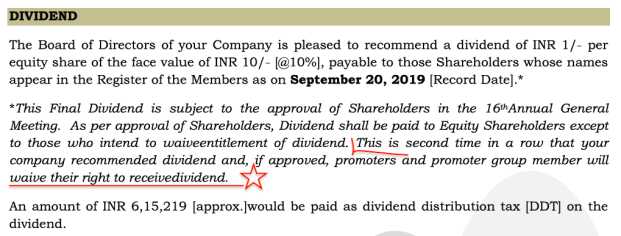

Talking about corporate governance to my surprise this is the second SME company I came across that gave dividends to minority shareholders and promoter part of the dividends invested back into the business, the other company which did this was South West Pinnacle Ltd.

Okay, How about post Covid-19 – how is it affecting their business?

Small businesses have some inherent size advantage –

” It takes lots of effort to turn a ” huge ship ” compared to a small one “

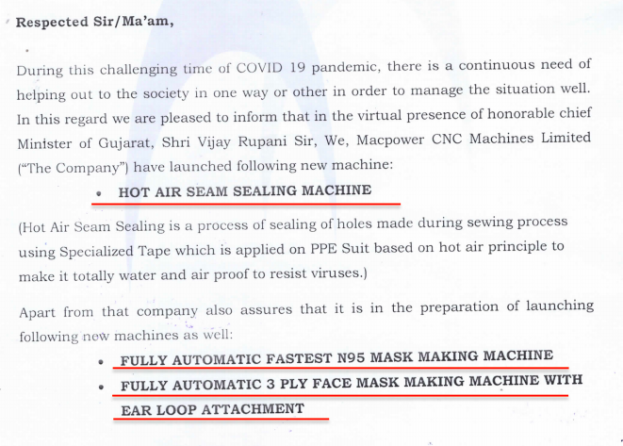

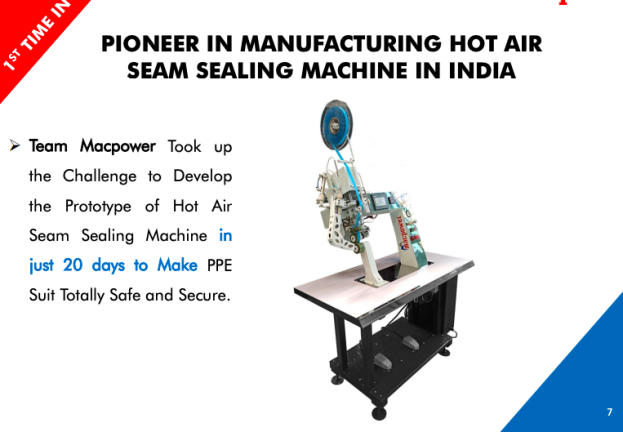

This is the most interesting part – This company actually not at all affected by the crisis probably business might be doing better.

Here is why –

They got some media coverage as well for pulling out this new product indigenously –

ABP NEWS LINK :- https://www.youtube.com/watch?v=3Gr-sk-oM8Y

ZEE NEWS LINK :- https://zeenews.india.com/gujarati/videos/gujarats-biggest-success-ppe-kit-will-be-easily-made-by-hot-air-seam-sealing-machine-93908

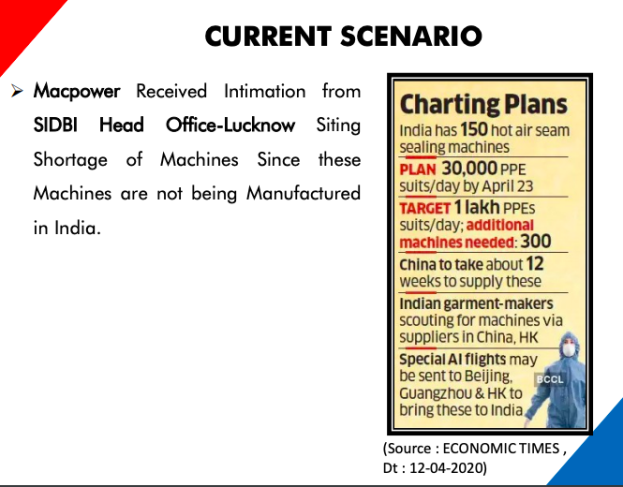

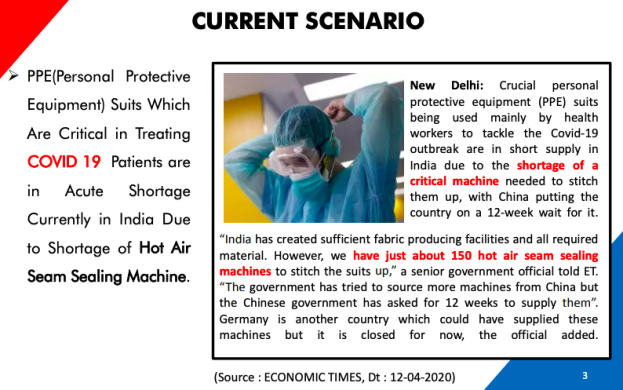

They were doing business of around 500 machines per year and as said in this video Mac Power already got the order of 250 Hot-Air Seam Sealing Machines for making PPEs in a matter of a few weeks.

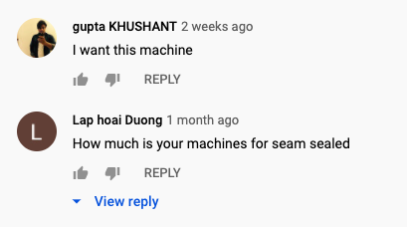

There seems to be huge pent up demand for these machines, As i was looking into youtube videos to understand these machines i came across these comments –

These are the snippet from 3 videos i came across on searching Hot Air Sealing Machines (not related to Mac Power CNC machines) –

I would highly recommend you to look into this presentation uploaded by the company-

https://www1.nseindia.com/corporate/MACPOWER_12052020123558_Update.pdf

How all this panned out ?

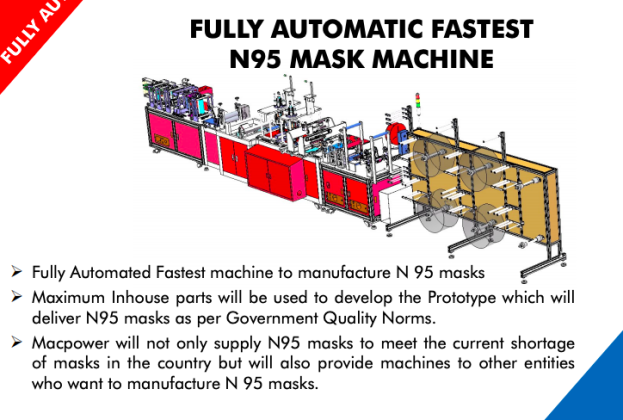

Moreover company is also working on developing prototype for producing Masks at large scale –

What’s going to happen post Covid-19?

Things will get back to where it was, they will continue catering to Defense, Aircraft, Automobile, Education sectors.

I would like to leave you with this question

Does the stock price correction justify what’s been happening on the ground ?

Some additional documents and links you may find interesting –

Conference Call Transcript – 20.08.2018 ( Must Listen)

https://www.macpowercnc.com/investor/transcript/

Presentation on Expansion project and redesign of existing products with certain changes.

NSE SME IPO Macpower CNC Machines Ltd Management Interview –

Blogging is tough : your support will be appreciated UPI id : dhruva.pandey@okhdfcbank

THANKS

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about the Business Quality, Management Quality, Business Execution & Performance.

Thanks, Dhruva Pandey Email : dhruva.pandey@outlook.com Twitter : https://twitter.com/Dhruvapandey UPI id : dhruva.pandey@okhdfcbank Twitter Handle : @Dhruvapandey

Don’t you think the business risks like scalability and highly competitive industry have not changed in any meaningful way? May be the distress will kill some of the highly leveraged competitors like you pointed out. The market share gains and hence the sales growth have to show a meaningful jump in 2 years. Any ideas on the market size and growth rates? I get your point that the correction has been too severe but how do you know that the risks are priced in? Is there something that the market is trying to tell?

LikeLiked by 1 person

Asking the tough questions

LikeLiked by 1 person

Hi Dhruv,

Thanks for another insightful post.

I have been tracking the SME space and agree that there are few interesting names and perhaps these are times to work on them.

Agree with you on Worth.

On Mac Power – a couple of friends visited the factory but were not happy. Will check with them. Also, though the new developments are good but don’t you worry that overall capital goods space would get badly hit and hence lower visibility for cos like Mac for sometime? Wouldn’t many cos just defer capex plans before things get back to normal?

LikeLike

Hard to say, Business for this sector went down during the first half of FY19 itself, In good days they used to do 500 machines , today they are doing already 250 machines for this PPE alone. If they become successful making machines for mask that will put them back into probably where they were around making 500 machines per day or even more. I don’t think virus going away in near future and people aren’t going to stop wearing masks even over a long term specially N-95 used in hospitals are mostly used and throw so, demand going to stay for a long (1-2 years).

Secondly, they get most of their order from Defense , Aerospace and Education institutes – These i believe got less affected by Virus. my goal is not to second guess next half yearly earnings or FY21 earnings.

My approach is to find decent (good) businesses which will survive (or grow) in this crisis then buy them cheap enough that whenever the growth will come back i can sell 4-5x of the value i paid for it today with in 4-5 years of time frame.

Of Course we can’t be sure of anything in investing so, i want to find as many as possible and diversify.

I like that these guys have hunger , energy and capability and Overall its a decent business with only 7 major players and good scope to build import substitutes.

Secondly, just a wild guess companies who are short of labor might want to scrap their conventional Machines and move to CNCs. This as to be seen but over long run i do see a trend towards automation and less dependence of labors etc.

and this whole push by government around the world to become self reliant will going to be great for capital goods sector that has to be seen.

Overall, given how situation is today and give how it could pan out in future i think this company is rightly placed and valuations looks good considering lot of pain has already been priced in.

LikeLiked by 1 person

This is not a capital goods company my dear !!!

LikeLike

Good evening Dhruvjee. Macpower is a fantastic company in niche area of working. I have listened MD’s interview on Youtube dated September, 2019. They are aiming to achieve Rs. 500 Crores annual turnover by next five years !!! I am owning few thousand shares of this blue-chip in the making which is smelled first by Midcap Moghul Mr. Kenneth Andrede !!!

LikeLike

VERY INFORMATIVE

LikeLike

Hi Dhruv,

Thanks for a detailed and insightful post. I am impressed with Macpower’s WC efficiency and the management’s energy. The tailwind for CNC machines is helping them too. I liked the level of disclosure throughout the annual report too.

Some red flag I noticed while going through the AR for FY20 :

1) Many senior employees (6 to be precise) resigned in the FY 2019-20. Designations inclide DGMs, President – R&D, etc. Wondering what was the reason for the same. There’s a chance that these guys were eyeing much higher salary/incentive for the year, but were dissapointed with no increments in remuneration for the year. But still, resignation of 6 out of 10 top employees is tough to digest.

2) Out of the disputed outstanding amounts related to VAT for the FY 2011-12, the company has incurred an interest cost of ₹1157660/- on an amount of ₹1607840/-. Why is there interest on Tax disputed amount in the first place?

3) They’ve changed the method of depreciation and have written off ₹2.45 Cr as mentioned in the cash flow statements of FY20

4) There is a guarantee issued by bank on behalf of Macpower worth ₹2.92 Cr. It was ₹2.62 Cr in FY19

5) They have disclosed an exhaustive list of items in PPE that includes a BMW car & Range Rover. The owners seem to be car lovers :). I just find it tough to understand the whole calculation of depreciation done

for PPE.

LikeLiked by 1 person

Hi , I floated ur questions via email to the company. Got the replay. Plz give me ur email id. I’ll forward it to u.

LikeLike

Hi Dhruv,

Sorry for the late reply. Incidentally, I too wrote to them and received answers from the management.

Nevertheless, would be great if you could share it at: bechucmathew@gmail.com.

LikeLike

Hi Dhruv,

that’s wonderful analysis ,

i am just going through the AR FY 19-20 but did not find any advances , I am missing something

also last time i say advances FY 15-16/ FY 15-14 (as per https://www.screener.in/ )

1) CFO for the past 6 years is 2cr vs PAT of 25 years

2) Receivables days on raise

3) most of the profit is being locked up in working capital

LikeLike

i think they book advances as revenue… & i doubt accounting of pre – ipo time frame. could be completely made up

LikeLike